Through a wave of mergers and acquisitions, coupled with downsizing or closing of financially-stressed hospitals, health systems are scrambling to re-position themselves in a changing marketplace that includes new Affordable Care Act incentives and penalties. Some hospitals and health systems are joining with physician practices and even insurance companies in integrated provider/payer arrangements that could improve care coordination, but also wield significant market and political power or—in the case of some religiously-affiliated systems—impede access to certain kinds of care. These dramatic changes will have lasting repercussions for consumers, especially those low-income patients who are dependent on local safety-net hospitals.

Yet most of these sweeping health industry changes are proceeding with little or no assessment of the likely impact on consumers and very little opportunity for community engagement in hospital regulatory oversight processes, some of which have been significantly weakened in recent years. Let’s take a look at the current state of play.

Recent Hospital Consolidation Trends

According to Modern Healthcare, the number of hospital mergers and acquisitions climbed by more than 18 percent to 109 in 2012, the third straight year of increasing hospital consolidation. These figures are double the annual average seen before health care reform and the 2008 recession. The volume of hospital mergers and acquisitions is expected to remain elevated as stand-alone hospitals join larger health systems seeking financial stability. According to the American Hospital Association, 436 hospitals gave up their independent status between 1999 and 2011. One hospital industry consulting firm predicts that another 1,000 hospitals could seek out mergers in the next several years.

Growth of For-Profit and Catholic-Sponsored Hospitals and Health Systems

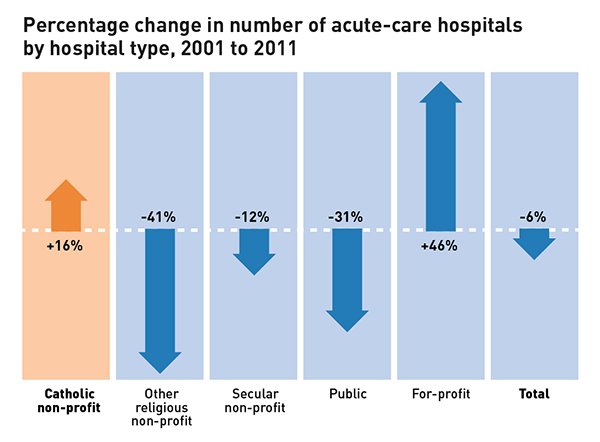

Research conducted by ACLU and the MergerWatch Project of Community Catalyst last year found that the number of for-profit hospitals jumped dramatically by 46 percent between 2001 and 2011, and the number of Catholic-sponsored hospitals increased by 16 percent, while the number of other non-profit and government-run hospitals decreased.

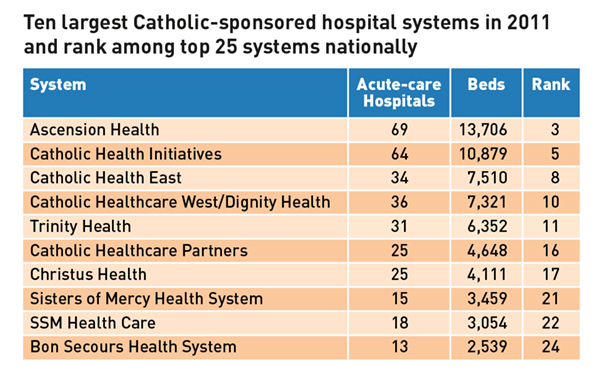

The study also found that for-profit and Catholic-sponsored systems dominated the 2011 roster of the 25 largest health systems in the nation.

There can be benefits for independent hospitals that merge with or are acquired by large health systems, such as greater access to capital for improvements to aging facilities, savings through joint purchasing and administration, and a financial “cushion” to help survive through hard times. But, there are also perils for hospitals and their patients. The shifting of local control to out-of-town system managers can mean a hospital is less responsive to community needs. Acquisition by a for-profit system can mean much greater attention to the bottom line, and sometimes, inappropriate practices such as demanding deposits from uninsured patients. Concerns remain that costs at for-profit hospitals could exceed those at non-profit hospitals.

In cases involving religiously-affiliated hospitals, issues of community access to care can arise. For example, secular hospitals that join a Catholic health system must cope with ethical and religious directives that can cause the elimination of key reproductive and end-of-life health services, including contraception, sterilization, infertility treatments, the treatment of pregnancy emergencies, “safer sex” counseling and the honoring of end-of-life wishes that contradict Catholic teaching.

Hospital consolidation can also lead to domination of local health marketplaces by one system, which then has greater ability to demand higher prices from insurers. New Yorker health care writer Atul Gawande demonstrated in a 2009 article that variation in health care costs between communities was relative to the amount of for-profit care in each area. In Massachusetts, the newly established Health Policy Commission and the Attorney General have been tasked to review whether a for-profit system’s proposed acquisition of two hospitals can both enhance quality of care and improve costs in what is becoming an increasingly consolidated market.

Decline of Publicly-Owned Hospitals

The ACLU/MergerWatch study found that government-owned hospitals, which traditionally perform far more uncompensated care than for-profit or other non-profit systems, have dropped 31 percent between 2001 and 2011. Heavily dependent on Medicaid funding and state or local funds, publicly-owned hospitals face an uncertain future as they struggle with declining reimbursements and the financial penalties attached to the quality-improvement initiatives offered in the Affordable Care Act.

Public hospitals in states that have yet to expand Medicaid to cover all adults earning up to 138 percent of the federal poverty level are especially vulnerable. These safety-net hospitals will likely face cutbacks in per-patient payments by Medicare and Medicaid without a corresponding increase in the number of insured patients among the low-income populations they serve.

Migration of non-acute care out of hospital settings

At the same time, health care experts expect ACA incentives to accelerate the pre-existing trend of moving non-acute medical care from hospitals to outpatient clinics, urgent care centers or short-stay surgi-centers. In some cases, these outpatient settings are affiliated with hospitals and can help reduce patient reliance on emergency departments. However, many of the new medical facilities that are unaffiliated with hospitals are located in places where they compete against each other for well-insured patients, potentially leaving behind the underinsured or uninsured in chronically underserved communities. Moreover, for-profit urgent care centers usually are under no obligation to provide charity care.

Weakened state regulatory review

These changes come at a time when many states do not have the authority to review hospital transactions or have weakened regulatory oversight which reviews the impact these deals may have on community need. Currently, 36 states have some sort of Certificate of Need program in place, with varying degrees of consumer protection. At least 24 states have enacted legislation regarding non-profit hospital conversion to for-profit entities, also with varying degrees of consumer protection. While some state and federal policymakers have begun jumping into the fray, a robust consumer advocacy response to the changing health industry landscape is clearly needed.

For more information about the report, please email MergerWatch staff directly at info@mergerwatch.org

Sheila Reynertson and Lois Uttley, MergerWatch